Content

If we are looking to sell short when a market starts to falter near a previous high, then many traders will place a stop loss above that previous high. Although this strategy normally means less time fixating on the market than when day trading, it does leave you at risk of any disruption overnight, or gapping. A crossover is one of the main moving average strategies, which is based on the meeting point or ‘cross’ of two standard indicators.

Therefore, their preferred trading strategy is based on higher time frames and bigger positions. An intraday trader holds a position open for no more than one day. Unlike the scalping trading strategy, trades are open for several hours. The most popular time intervals include H1 and H4.Due to this, you can evaluate the situation without emotions and haste. Forex channel strategy can be applied when a certain price corridor (channel) is clearly observed on the chart. The channel boundaries can be determined by the upper and lower bar, beyond which the value of the currency doesn’t cross over a certain period of time.

Advanced forex trading strategies

This approach requires opening a large number of trades in the hopes of making small gains from each one. Trend-following is one of the simplest strategies for a beginner to learn. If a trader has identified the trend’s direction, he or she must open positions in that direction. The market will often react quite aggressively after the breakout occurs, allowing traders to secure a large profit in a relatively short period of time.

This strategy relies on both technical and fundamental forms of analysis. On the technical side, traders use momentum indicators and moving averages to analyze price movement over multiple days. From a fundamental standpoint, swing traders often use micro- and macroeconomic indicators to help determine the value of an asset. News traders typically need to monitor economic calendars for key data releases.

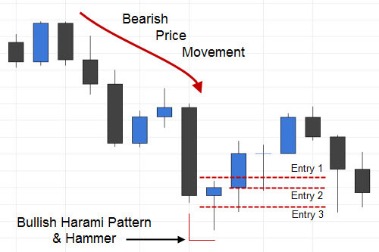

Suddenly a level where buyers were happy to buy as they viewed the market as cheap and expected it to rise – has been broken. This breakthrough of what is known as a support level can be viewed as an opportunity to short sell and try to profit from further weakness in price. As you choose which strategy to pursue, it’s important to take experience and circumstance into account. If you’re just starting out in forex, day-trading strategies that demand quick action and require you to manage multiple trades at a time may not be ideal learning environments. Swing traders tend to focus on entering and existing positions based on momentum indicators that provide buy and sell signals. Traders use them to find overbought or oversold markets they can sell or buy.

This belongs to a family of trading tools known as oscillators – so-called because they oscillate as the markets move. When the RSI is above 70%, the market is thought to be overbought. This means that it could be getting overstretched and some traders will use this as a signal to expect the market to fall back. Sometimes, when people refer to a forex strategy, they’re talking about a style of trading – be that position trading, swing trading, day trading or scalping.

Support and Resistance Strategy

Nonetheless, this strategy is recommended for complete beginners who are just getting introduced to forex trading. To make choosing a strategy easy, we’ve made a list of the most popular trading tactics and separated them by how much time they take to implement and how risky they are. Some are very beginner-friendly and can make you your first profits today, while some take more time to master but will bring pure joy (and material gain) once you figure them out. Let’s check out a few forex strategies that work, and see which one is perfect for you.

In fact, if such a strategy existed, it would eliminate the essence of trading itself. Both strategies can be stressful and require being able to stay extremely focused and available in front of your trading desk while you’re trading. As part of our efforts to safeguard our clients, DB Invest offers extra protection through Civil Liability Insurance, covering traders for up to $20.000. If you want to succeed in the forex world, you have to come up with a proper strategy. If you don’t have any strategy, you can see your dollar bills saying „bye-bye“ to you.

What is the most successful trading strategy?

Picking a forex strategy is one of the most important things you can do to help assure your profitability as a currency trader, so you will definitely want to choose a successful strategy. This strategy has an interesting modification based on similar logic. Investors, day traders, working with a trading volume prefer intraday strategies. They do not have enough money to make a strong influence on the market.

- Both strategies can be stressful and require being able to stay extremely focused and available in front of your trading desk while you’re trading.

- The 50-day moving average crossing above the 200-day moving average could indicate the beginning of an uptrend, and vice-versa.

- The more time you take to learn and practice a certain strategy, the more adept you’ll become at its execution.

- An FX trader would enter into a long position when the fast EMA crosses the slow EMA from below, and enter into a short position when the fast EMA crosses the slow EMA from above.

- However, first, you need to try many other strategies that have been developed and tested.

Forex trading strategies are methodologies for entering and exiting FX positions. They’re usually based on various analysis techniques – both technical and fundamental – and give traders a way of knowing when to buy or sell a currency pair. Creating and sticking to a forex trading strategy is key to being a successful currency trader. The Inner Circle Trader (ICT) forex strategy was developed by Michael Huddleston, https://g-markets.net/helpful-articles/what-is-a-spread-trade/ a successful forex trader, trainer, and founder of the ICT strategy. His approach is based on market structure, liquidity, and supply & demand, which he believes are key factors in understanding the market and making better decisions in trading. Range trading, also known as sideways trading, is employed when the market is moving within a defined range, characterized by horizontal price movements.

Major (scheduled) news events include:

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. Since these centers span all time zones, traders have 24-hour access to the global forex market and can trade whenever they wish. All this and more impacts the forex market, but learning how to trade forex should be your priority if you’re just starting. Forex brokers offer many different financial instruments—currency pairs, cryptos, CFDs, spreads, etc. Upward trending financial instruments are always a good target for day traders.

Trend following is one of the most popular and well-known forex trading strategies out there. This strategy involves identifying the current trend in the market and then following it by buying or selling accordingly. Scalping is one of the most popular FX trading strategies used on low timeframes where an asset’s rate rapidly changes. The idea is to open numerous trades to compensate for their short period — usually, positions close within 30 minutes. Our Forex master trader coaches will show you exactly how we trade the markets every day. In addition, our prop lives forex trading rooms feature our prop traders, trading every day.

Time frame

There is a variety of price action strategies you could utilise – from breakouts to reversals to simple and advanced candlestick patterns. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips. Forex scalping is a popular trading strategy that is focused on smaller market movements.

Open an account to start practising your forex trading strategies via spread bets and CFDs. There is also a strategy for part-time traders who pop in and out of work (10 minutes at a time). These brief but frequent trading periods may lend themselves to implementing a price action trading strategy.

This works great with trending pairs that are slowly losing steam. In the two EUR/USD day trading examples above, that is exactly what happened. The advantage of day trading Forex is that you will not be marked as a pattern day trader. Also, the markets are a lot more volatile in Forex, so you can capture a big move quickly.

To protect oneself against an undesirable move in a currency pair, traders can hold both a long and short position simultaneously. This offsets your exposure to the potential downside but also limits any profit. By playing both sides of the market, you can get an idea of the direction the trend is heading, so you can potentially close your position and re-enter at a better price.

A forex trading strategy aids traders in determining when or where they should buy or sell a specific currency pair. There is also a wide range of advanced forex trading strategies, with each needing different levels of technical and fundamental analysis. It is essential to have a plan when trading forex, that is, when you are buying and selling currency pairs on the forex market.